本文摘要:

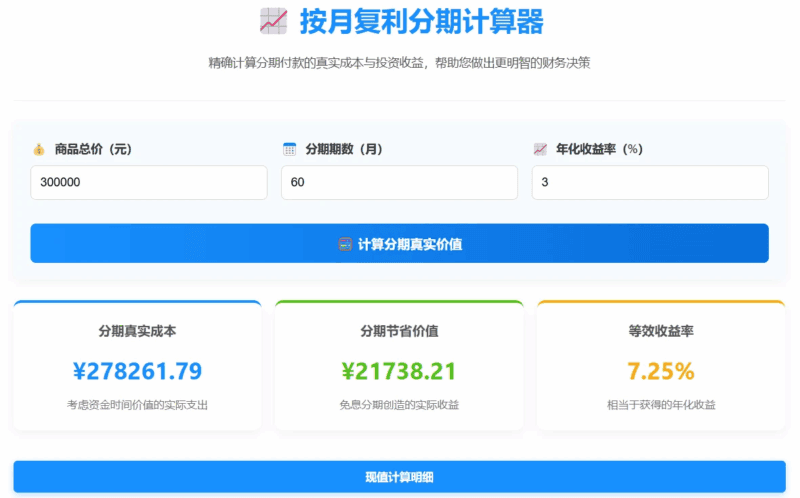

文章探讨了购车免息分期的实际价值,以30万元购车5年免息为例,手握本金年收益率达3%的情况下,分期实际等效降价价值为21738.21元。该文提供了一个按月复利分期计算器的网页工具,基于折现现金流模型和复利原理,帮助用户分析分期付款的真实成本、节省价值及等效收益率。工具支持现值、终值和投资复利分析三种计算模式,直观展示资金的时间价值,用于对比一次性支付与分期付款的实际财务差额并支持决策。

— 本文部分摘要灵感源自 DeepSeek 深度思考 ✨

“特斯拉买车 5 年年息等于变相降价”

打个比方,30 万买车,5 年免息,如果你手握本金年华收益能达到 3%,具体相当于降价多少

![图片[1]|搞了个小玩意,比如你买车免息5年,免息的价值到底是多少|不死鸟资源网](https://busi.net/wp-content/uploads/2025/06/20250607080139396-image-1024x637.png)

相当于:21738.21

体验链接:https://skybook.vip/program/mianxi/

<!DOCTYPE html>

<html lang="zh">

<head>

<meta charset="UTF-8">

<meta name="viewport" content="width=device-width, initial-scale=1.0">

<title>按月复利分期计算器</title>

<style>

:root {

--primary: #1890ff;

--primary-dark: #096dd9;

--accent: #52c41a;

--light: #f8f9fa;

--dark: #2d3436;

--border: #d9d9d9;

--card-radius: 12px;

}

* {

box-sizing: border-box;

margin: 0;

padding: 0;

}

body {

font-family: 'Segoe UI', 'Microsoft YaHei', sans-serif;

padding: 20px;

background: linear-gradient(135deg, #e3f2fd, #f0f7ff);

color: #333;

line-height: 1.6;

min-height: 100vh;

}

.container {

max-width: 1200px;

margin: 30px auto;

background: white;

padding: 30px;

border-radius: var(--card-radius);

box-shadow: 0 10px 30px rgba(0, 0, 0, 0.1);

}

header {

text-align: center;

margin-bottom: 30px;

padding-bottom: 20px;

border-bottom: 1px solid #eee;

}

h1 {

color: var(--primary);

margin-bottom: 15px;

font-size: 2.5rem;

}

.description {

font-size: 1.1rem;

color: #555;

max-width: 800px;

margin: 0 auto 20px;

line-height: 1.8;

}

.calculator {

background: #f8fbff;

padding: 25px;

border-radius: var(--card-radius);

box-shadow: 0 4px 15px rgba(0, 0, 0, 0.05);

margin-bottom: 30px;

}

.input-grid {

display: grid;

grid-template-columns: repeat(auto-fit, minmax(250px, 1fr));

gap: 20px;

margin-bottom: 20px;

}

.input-group {

display: flex;

flex-direction: column;

}

label {

display: block;

margin-bottom: 10px;

font-weight: 600;

color: var(--dark);

font-size: 1.1rem;

display: flex;

align-items: center;

}

label span.icon {

margin-right: 10px;

font-size: 1.2rem;

}

input {

width: 100%;

padding: 14px;

border: 1px solid var(--border);

border-radius: 8px;

font-size: 1.1rem;

background: white;

}

input:focus {

outline: none;

border-color: var(--primary);

box-shadow: 0 0 0 3px rgba(24, 144, 255, 0.2);

}

button {

padding: 16px;

background: linear-gradient(to right, var(--primary), var(--primary-dark));

color: white;

font-size: 1.2rem;

font-weight: 600;

border: none;

border-radius: 8px;

cursor: pointer;

transition: all 0.3s;

margin-top: 15px;

width: 100%;

}

button:hover {

background: linear-gradient(to right, var(--primary-dark), #0050b3);

transform: translateY(-3px);

box-shadow: 0 7px 15px rgba(24, 144, 255, 0.3);

}

.results {

display: grid;

grid-template-columns: repeat(auto-fit, minmax(250px, 1fr));

gap: 20px;

margin: 30px 0;

}

.result-card {

background: white;

padding: 25px;

border-radius: var(--card-radius);

box-shadow: 0 5px 15px rgba(0, 0, 0, 0.05);

text-align: center;

border-top: 4px solid var(--primary);

position: relative;

overflow: hidden;

}

.result-card:nth-child(2) {

border-top: 4px solid var(--accent);

}

.result-card:nth-child(3) {

border-top: 4px solid #faad14;

}

.result-title {

font-size: 1.2rem;

color: #555;

margin-bottom: 15px;

font-weight: 600;

}

.result-value {

font-size: 2.2rem;

font-weight: 700;

color: var(--primary);

margin: 10px 0;

}

.result-card:nth-child(2) .result-value {

color: var(--accent);

}

.result-card:nth-child(3) .result-value {

color: #faad14;

}

.result-subtext {

font-size: 1rem;

color: #777;

margin-top: 10px;

}

.toggle-section {

display: flex;

justify-content: center;

gap: 15px;

margin: 20px 0 25px;

flex-wrap: wrap;

}

.toggle-button {

padding: 12px 25px;

background: #edf2f7;

border: none;

border-radius: 6px;

font-weight: 600;

cursor: pointer;

transition: all 0.3s;

font-size: 1.05rem;

}

.toggle-button.active {

background: var(--primary);

color: white;

box-shadow: 0 3px 10px rgba(24, 144, 255, 0.3);

}

.table-section {

margin: 25px 0;

overflow-x: auto;

border-radius: var(--card-radius);

box-shadow: 0 5px 15px rgba(0, 0, 0, 0.05);

}

table {

width: 100%;

border-collapse: collapse;

background: white;

}

th, td {

padding: 14px 15px;

text-align: center;

}

th {

background: var(--primary);

color: white;

font-weight: 600;

position: sticky;

top: 0;

}

tr:nth-child(even) {

background-color: #f0f8ff;

}

tr:hover {

background-color: #e6f7ff;

}

.explanation-section {

margin: 40px 0 20px;

}

.explanation-card {

background: #fffbe6;

border-left: 4px solid #faad14;

padding: 25px;

border-radius: var(--card-radius);

margin-bottom: 30px;

}

.explanation-title {

font-size: 1.5rem;

margin-bottom: 20px;

color: #d48806;

display: flex;

align-items: center;

}

.explanation-title span.icon {

margin-right: 10px;

font-size: 1.8rem;

}

.calculation-method {

margin-top: 25px;

padding: 20px;

background: #f0f8ff;

border-radius: var(--card-radius);

border-left: 4px solid var(--primary);

}

.method-title {

font-size: 1.3rem;

margin-bottom: 15px;

color: var(--primary);

}

.formula {

font-family: 'Consolas', monospace;

background: #f8f8f8;

padding: 15px;

border-radius: 8px;

margin: 15px 0;

font-size: 1.1rem;

text-align: center;

border-left: 4px solid var(--accent);

}

@media (max-width: 768px) {

.container {

padding: 20px;

}

.results {

grid-template-columns: 1fr;

}

.toggle-section {

flex-direction: column;

align-items: center;

}

.toggle-button {

width: 90%;

}

}

footer {

text-align: center;

margin-top: 40px;

padding-top: 20px;

border-top: 1px solid #eee;

color: #777;

}

</style>

</head>

<body>

<div class="container">

<header>

<h1>📈 按月复利分期计算器</h1>

<p class="description">精确计算分期付款的真实成本与投资收益,帮助您做出更明智的财务决策</p>

</header>

<div class="calculator">

<div class="input-grid">

<div class="input-group">

<label for="price"><span class="icon">💰</span> 商品总价(元)</label>

<input type="number" id="price" value="10000" min="1" step="100">

</div>

<div class="input-group">

<label for="months"><span class="icon">📅</span> 分期期数(月)</label>

<input type="number" id="months" value="12" min="1" step="1">

</div>

<div class="input-group">

<label for="rate"><span class="icon">📈</span> 年化收益率(%)</label>

<input type="number" id="rate" value="3" step="0.1" min="0" max="50">

</div>

</div>

<button id="calculate-btn"><span class="icon">🧮</span> 计算分期真实价值</button>

</div>

<div class="results">

<div class="result-card">

<div class="result-title">分期真实成本</div>

<div class="result-value" id="trueCost">¥ --</div>

<div class="result-subtext">考虑资金时间价值的实际支出</div>

</div>

<div class="result-card">

<div class="result-title">分期节省价值</div>

<div class="result-value" id="benefit">¥ --</div>

<div class="result-subtext">免息分期创造的实际收益</div>

</div>

<div class="result-card">

<div class="result-title">等效收益率</div>

<div class="result-value" id="rateEquivalent">-- %</div>

<div class="result-subtext">相当于获得的年化收益</div>

</div>

</div>

<div class="toggle-section">

<button class="toggle-button active" onclick="showTable('pv')">现值计算明细</button>

<button class="toggle-button" onclick="showTable('fv')">终值计算明细</button>

<button class="toggle-button" onclick="showTable('invest')">投资复利分析</button>

</div>

<div class="table-section">

<div id="pv-table">

<table>

<thead>

<tr>

<th>期数</th>

<th>每期支付</th>

<th>折现因子</th>

<th>折现现值</th>

<th>累计现值</th>

</tr>

</thead>

<tbody id="pv-table-body">

<tr>

<td colspan="5" style="text-align: center; padding: 30px;">请输入参数并点击计算按钮</td>

</tr>

</tbody>

</table>

</div>

<div id="fv-table" style="display:none">

<table>

<thead>

<tr>

<th>期数</th>

<th>每期支付</th>

<th>复利因子</th>

<th>复利终值</th>

<th>累计终值</th>

</tr>

</thead>

<tbody id="fv-table-body">

<tr>

<td colspan="5" style="text-align: center; padding: 30px;">请输入参数并点击计算按钮</td>

</tr>

</tbody>

</table>

</div>

<div id="invest-table" style="display:none">

<table>

<thead>

<tr>

<th>期数</th>

<th>新增资金</th>

<th>月收益率</th>

<th>当期收益</th>

<th>累计本金+收益</th>

<th>总收益率</th>

</tr>

</thead>

<tbody id="invest-table-body">

<tr>

<td colspan="6" style="text-align: center; padding: 30px;">请输入参数并点击计算按钮</td>

</tr>

</tbody>

</table>

</div>

</div>

<div class="explanation-section">

<div class="explanation-card">

<h2 class="explanation-title"><span class="icon">📊</span> 计算器功能说明</h2>

<p>按月复利分期计算器是一个帮助您理解分期付款真实价值的工具。它可以帮助您:</p>

<ul style="margin-left: 20px; margin-top: 15px;">

<li><strong>分析免息分期付款的实际价值</strong> - 计算分期购买商品的真实成本</li>

<li><strong>衡量资金的时间价值</strong> - 了解延迟支付现金的经济效益</li>

<li><strong>模拟投资增长</strong> - 如果将分期节省的现金用于投资,能得到多少收益</li>

<li><strong>做出更明智的财务决策</strong> - 比较一次性付款和分期付款的实际价值差异</li>

</ul>

<p style="margin-top: 20px;">这个计算器基于财务学中的<strong>折现现金流(DCF)模型</strong>和<strong>复利计算原理</strong>,为分期付款提供了三种不同视角的分析。</p>

</div>

<div class="calculation-method">

<h3 class="method-title">计算模型与原理说明</h3>

<div class="explanation-card">

<h3 class="explanation-title"><span class="icon">💰</span> 现值计算模型</h3>

<p>现值计算模型用于确定分期支付现金流的当前价值。这是一种常用财务分析方法,将未来现金流的价值调整到当前的等价金额。</p>

<div class="formula">

折现因子 = 1 / (1 + 月利率)<sup>期数</sup>

</div>

<p><strong>其中:</strong></p>

<ul>

<li>月利率 = 年化收益率 ÷ 100 ÷ 12</li>

<li>每期折现现值 = 每期支付金额 × 折现因子</li>

<li>真实成本 = ∑(每期折现现值)</li>

<li>分期节省价值 = 商品总价 - 真实成本</li>

</ul>

</div>

<div class="explanation-card">

<h3 class="explanation-title"><span class="icon">📈</span> 终值计算模型</h3>

<p>终值计算模型展示如果分期节省的现金流用于投资,到期后这些资金会增长到多少。它模拟了分期节省资金的投资收益。</p>

<div class="formula">

复利因子 = (1 + 月利率)<sup>(总期数 - 当前期数)</sup>

</div>

<p><strong>其中:</strong></p>

<ul>

<li>每期终值 = 每期支付金额 × 复利因子</li>

<li>总终值 = ∑(每期终值)</li>

<li>一次性支付终值 = 商品总价 × (1 + 月利率)<sup>总期数</sup></li>

</ul>

</div>

<div class="explanation-card">

<h3 class="explanation-title"><span class="icon">💹</span> 投资复利分析</h3>

<p>投资复利分析模拟逐月投资分期节省的现金。它展示了分期节省的现金流如何通过按月复利的方式增长。</p>

<div class="formula">

第n期末值 = (第n-1期末值 + 本期新增金额) × (1 + 月利率)

</div>

<p><strong>其中:</strong></p>

<ul>

<li>每期新增资金 = 每期支付金额</li>

<li>每期收益 = (上期余额 + 本期新增金额) × 月利率</li>

<li>总收益率 = (期末余额 - 累计投资额) ÷ 累计投资额 × 100%</li>

</ul>

</div>

</div>

</div>

<footer>

<p>© 2023 按月复利分期计算器 | 专业财务分析工具</p>

</footer>

</div>

<script>

document.getElementById('calculate-btn').addEventListener('click', calculate);

function showTable(tableId) {

// 隐藏所有表格

document.getElementById('pv-table').style.display = 'none';

document.getElementById('fv-table').style.display = 'none';

document.getElementById('invest-table').style.display = 'none';

// 重置按钮状态

document.querySelectorAll('.toggle-button').forEach(btn => {

btn.classList.remove('active');

});

// 显示选择的表格

document.getElementById(tableId + '-table').style.display = 'block';

// 激活对应按钮

document.querySelector(`.toggle-button[onclick="showTable('${tableId}')"]`).classList.add('active');

}

function calculate() {

// 获取输入值

const price = parseFloat(document.getElementById("price").value);

const months = parseInt(document.getElementById("months").value);

const annualRate = parseFloat(document.getElementById("rate").value);

// 验证输入

if (price <= 0 || months <= 0 || annualRate < 0) {

alert("请输入有效的数值:商品总价和期数必须大于0,年化收益率不能为负数");

return;

}

// 计算月利率

const monthlyRate = annualRate / 100 / 12;

// 计算每期支付金额

const monthlyPayment = price / months;

// 初始化计算结果变量

let totalPresentValue = 0;

let totalFutureValue = 0;

let investmentBalance = 0;

let pvTableHTML = '';

let fvTableHTML = '';

let investTableHTML = '';

// 计算每期的现值、终值和投资增长

for (let t = 1; t <= months; t++) {

// ======== 现值计算 ========

const discountFactor = 1 / Math.pow(1 + monthlyRate, t);

const presentValue = monthlyPayment * discountFactor;

totalPresentValue += presentValue;

// 构建现值表格

pvTableHTML += `

<tr>

<td>${t}</td>

<td>¥${monthlyPayment.toFixed(2)}</td>

<td>${discountFactor.toFixed(6)}</td>

<td>¥${presentValue.toFixed(2)}</td>

<td>¥${totalPresentValue.toFixed(2)}</td>

</tr>

`;

// ======== 终值计算 ========

const futureValueFactor = Math.pow(1 + monthlyRate, months - t);

const futureValue = monthlyPayment * futureValueFactor;

totalFutureValue += futureValue;

// 构建终值表格

fvTableHTML += `

<tr>

<td>${t}</td>

<td>¥${monthlyPayment.toFixed(2)}</td>

<td>${futureValueFactor.toFixed(6)}</td>

<td>¥${futureValue.toFixed(2)}</td>

<td>¥${totalFutureValue.toFixed(2)}</td>

</tr>

`;

// ======== 投资复利分析 ========

const previousBalance = investmentBalance;

const monthlyInterest = (previousBalance + monthlyPayment) * monthlyRate;

investmentBalance = (previousBalance + monthlyPayment) * (1 + monthlyRate);

const totalInvestment = monthlyPayment * t;

const totalReturn = investmentBalance - totalInvestment;

const returnRate = (totalReturn / totalInvestment) * 100;

// 构建投资分析表格

investTableHTML += `

<tr>

<td>${t}</td>

<td>¥${monthlyPayment.toFixed(2)}</td>

<td>${(monthlyRate * 100).toFixed(2)}%</td>

<td>¥${monthlyInterest.toFixed(2)}</td>

<td>¥${investmentBalance.toFixed(2)}</td>

<td>${returnRate.toFixed(2)}%</td>

</tr>

`;

}

// 计算结果

const trueCost = totalPresentValue;

const benefit = price - trueCost;

const rateEquivalent = (benefit / price * 100).toFixed(2);

// 更新结果展示

document.getElementById("trueCost").textContent = "¥" + trueCost.toFixed(2);

document.getElementById("benefit").textContent = "¥" + benefit.toFixed(2);

document.getElementById("rateEquivalent").textContent = rateEquivalent + "%";

// 更新表格

document.getElementById("pv-table-body").innerHTML = pvTableHTML;

document.getElementById("fv-table-body").innerHTML = fvTableHTML;

document.getElementById("invest-table-body").innerHTML = investTableHTML;

// 确保现值表格默认可见

document.getElementById('pv-table').style.display = 'block';

}

// 页面加载后自动计算一次

window.onload = function() {

calculate();

// 设置默认激活按钮

document.querySelector('.toggle-button').classList.add('active');

};

</script>

</body>

</html>本站文章部分内容可能来源于网络,仅供大家学习参考,如有侵权,请联系站长📧ommind@qq.com进行删除处理!

THE END